Mumbai: The Reserve Bank of India has raised upwards its retail inflation projection for the last quarter of the current fiscal to 6.5 per cent on increase in prices of milk, pulses amid volatile crude oil prices and termed the overall outlook on price rise as “highly uncertain”.

Going forward, the inflation outlook is likely to be influenced by several factors like food inflation, crude prices and input costs for services, RBI said.

On food inflation, RBI said it is likely to soften from the high levels registered in December and the decline is expected to become more pronounced during the fourth quarter of this fiscal as onion prices ease following arrivals of late kharif and rabi harvests, the Reserve Bank of India (RBI) said in its last bi-monthly monetary policy revealed Thursday.

The RBI has kept the key repo rate unchanged to 5.15 per cent. “Taking into consideration these factors, and under the assumption of a normal south west monsoon in 2020-21, the CPI inflation projection is revised upwards to 6.5 per cent for Q4:2019-20 (January-March 2020); 5.4-5 per cent for H1:2020-21 (April-September 2020); and 3.2 per cent for Q3:2020-21 (October-December), with risks broadly balanced,” RBI said.

RBI said the recent pick-up in prices of non-vegetable food items, specifically in milk due to a rise in input costs, and in pulses due to a shortfall in kharif production, are all likely to sustain.

“These factors could impart some upward bias to overall food prices. Second, crude prices are likely to remain volatile due to unabating geo-political tensions in the Middle East on the one hand, and the uncertain global economic outlook on the other. Third, there has been an increase in input costs for services, in recent month,” it added.

Talking about high onion prices that ranged between Rs 150-200 a kg in the recent past, RBI said the actual inflation outcome for Q2 at 5.8 per cent overshot projections by 70 bps, primarily due to the intensification of the “onion price shock” in December 2019 on account of unseasonal rains in October-November.

In its previous monetary policy in December 2019 as well, the RBI had raised its inflation projection to 5.1-4.7 per cent for the second half of the current fiscal on the back of spike in prices of vegetables such as onion and tomatoes.

Subdued demand conditions, muted pricing power of corporates and correction in energy prices since the last week of January may limit the pass-through to selling prices, RBI said.

“Base effects would turn favourable during Q3:2020-21 and the increase in customs duties on items of retail consumption in the budget may result in only a marginal one-time uptick in inflation,” RBI said.

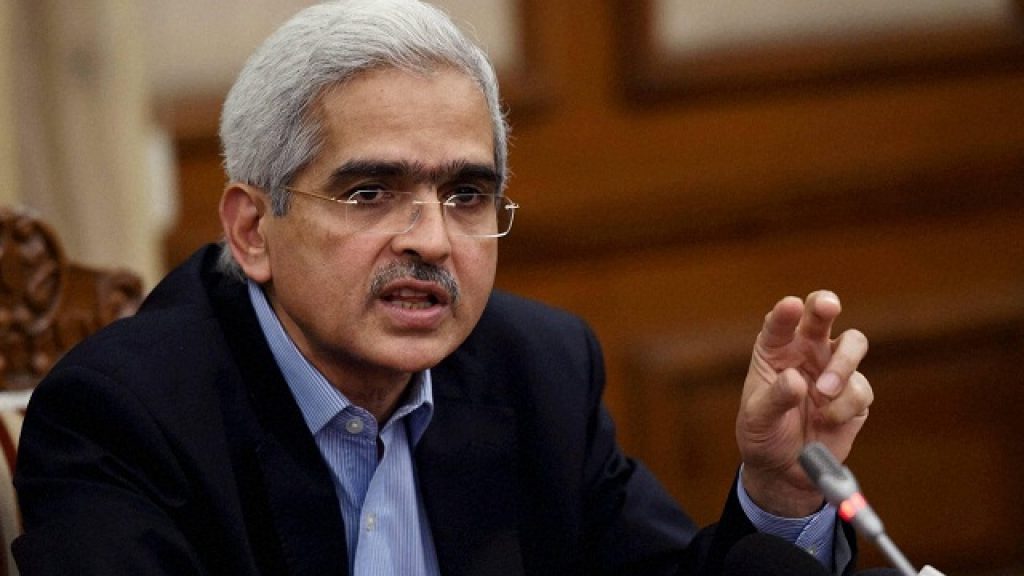

Meanwhile, Das said the decision to conduct new one-year and three-year repos worth Rs 1 lakh crore, is aimed at ensuring better monetary policy transmission.

In the sixth bi-monthly policy, the Reserve Bank of India (RBI) announced term repurchase agreements (repos) of one-year and three-year tenors of appropriate sizes for a total amount of Rs 1 lakh crore at the policy repo rate, from the fortnight beginning on February 15.

“It is an effort to ensure better monetary policy transmission. It will enable banks to reduce their lending rates,” Das told reporters in the post policy conference.

The RBI has cumulatively cut the repo rate by 135 basis since February 2019 to a nine-year low of 5.15 per cent.

He said monetary transmission across various money market segments and the private corporate bond market has been sizable.

After leaving benchmark interest rates unchanged in the second consecutive policy review, RBI governor said the central bank has many other instruments to address the sluggishness the economy, not just interest rates.

The RBI in its sixth bi-monthly monetary policy pegged GDP growth for FY21 at 6 per cent, but guided towards an uncertain inflation outlook.

In a January 31 release, the National Statistical Office (NSO) had revised down real GDP growth for FY19 to 6.1 per cent from 6.8 per cent provided in the provisional estimates of May 2019. Given this, the central bank noted that the economy is still plagued by deep output gaps.

“The RBI has several instruments to address the sluggishness in the growth momentum,” Das told reporters at the customary post-policy conference.

The monetary policy committee (MPC) kept the policy repo rate unchanged at 5.15 per cent, continuing with the accommodative stance to revive growth.

The governor said the continuity in policy from last pause should not be read as a pointer to future actions. “While the decision is as per expectations, it is important not to discount RBI,” he said.

PTI