Mumbai: The Reserve Bank of India Friday raised the GDP growth projection for the current fiscal to 7 per cent from 6.5 per cent earlier on buoyant domestic demand and higher capacity utilisation in the manufacturing sector.

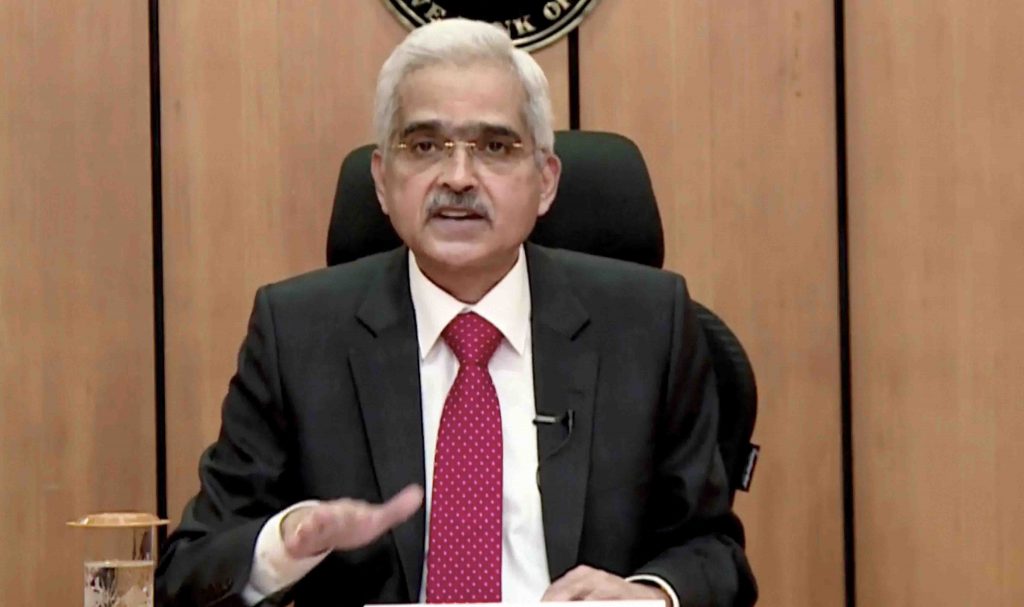

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das, however, flagged protracted geopolitical turmoil and global economic fragmentation as risks to the growth outlook.

The RBI kept interest rates unchanged at 6.5 per cent in Friday’s monetary policy statement.

The apex bank projected real GDP growth for the 2023-24 fiscal at 7 per cent, with December and March quarter growth estimated at 6.5 per cent and 6 per cent, respectively.

The growth in the first, second and third quarters of the next fiscal is estimated at 6.7 per cent, 6.5 per cent, and 6.4 per cent, respectively.

The Indian economy rose by 7.2 per cent in the 2022-23 fiscal ended March 2023.

The country’s real GDP grew 7.8 per cent and 7.6 per cent year-on-year in the June and September quarters, up from 6.1 per cent in the March quarter.

The central bank’s projection is significantly higher than forecasts by international agencies.

The IMF, World Bank, ADB, and Fitch expect India’s GDP to expand 6.3 per cent in the current fiscal, while S&P expects growth to be 6.4 per cent in the current fiscal.

The RBI said the buoyancy in public sector capex, above-average capacity utilisation in manufacturing and domestic demand will help boost growth.

The total flow of resources to the commercial sector stood at Rs 17.6 lakh crore during the current fiscal, significantly higher than Rs 14.5 lakh crore last year.

Despite weakness in external demand, exports were positive in October. Private consumption should gain from rural demand, manufacturing and buoyancy in services. The healthy balance sheet of corporate, business optimism and government infrastructure spending will boost public sector capex, Das said.