Mumbai: The Reserve Bank of India (RBI) decided Friday to restore the cash reserve ratio (CRR) in a phased manner to 4 per cent. This decision was taken in light of improved liquidity condition in the market. The CRR is the percentage of the total deposit that banks have to mandatorily park with the apex bank. The move to raise CRR would suck about Rs 1.37 lakh crore primary liquidity from the banking system.

To help banks tide over the disruption caused by COVID-19, the CRR of all banks was reduced by 100 basis points to 3.0 per cent of net demand and time liabilities (NDTL) effective from the reporting fortnight beginning March 28, 2020. The dispensation was available for a period of one year ending March 26, 2021.

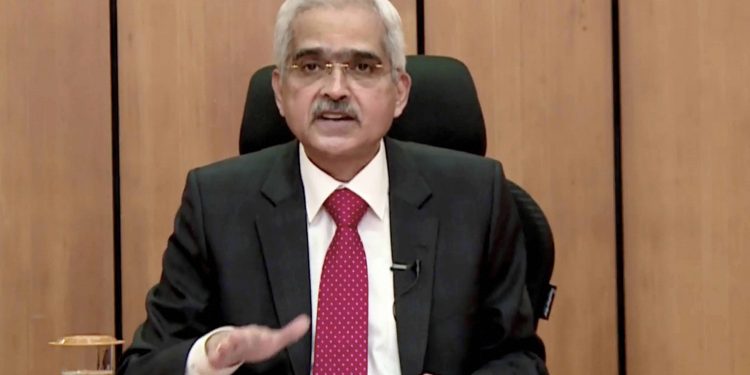

“On a review of monetary and liquidity conditions, it has been decided to gradually restore the CRR in two phases in a non-disruptive manner. Banks would now be required to maintain the CRR at 3.5 per cent of NDTL effective from the reporting fortnight beginning March 27, 2021 and 4.0 per cent of NDTL effective from fortnight beginning May 22, 2021,” RBI Governor Shaktikanta Das said.

RBI last reduced the CRR in November 2011 by 25 basis points from 4.25 per cent to 4 per cent.

Reconstruction of PMC Bank

In a separate development Das said three investors have submitted their offers for reconstruction of crisis-ridden Punjab and Maharashtra Co-operative (PMC) Bank and evaluation for those are underway. Last month, PMC Bank administrator AK Dixit in a letter to customers and stakeholders had informed that three prospective investors were given time till February 1, 2021 for submission of their final offer.

Also read: RBI keeps repo rate unchanged at 4 per cent for 4th time in a row

“I have been informed that three final offers have been received. I am given to understand that the PMC Bank itself is evaluating the offers,” the RBI governor told reporters after announcing the monetary policy. He said once the evaluation is done, the bank would approach the RBI.

Digital currency implementation

An internal committee within the RBI is taking a close look at the model of the central bank’s digital currency. It will come out with its decision ‘very soon’, Deputy RBI Governor BP Kanungo said Friday.

It can be noted that the RBI had earlier announced its intent to come out with an official digital currency. This decision was taken in the face of proliferation of cryptocurrencies like Bitcoin about which the central bank has had many concerns. The government last week moved to ban private cryptocurrencies.

“With regard to digital currency, I think we have already released our document. Our digital payment document spells out that digital currency is work in progress in RBI,” Das told reporters Friday.

Kanungo said having a digital currency was an announcement done by the monetary policy committee some time ago. “We had a committee that is still on the drawing board. In fact, an internal committee is taking a close look to decide on the model of the central bank digital currency and you will hear from the Reserve Bank very soon in the matter,” Kanungo added.

Private digital currencies (PDCs) / virtual currencies (VCs) / crypto currencies (CCs) have gained popularity in recent years.