Mumbai: RBI allowed Wednesday certain individual and small borrowers more time to repay debt and allowed banks to give priority loans to vaccine makers, hospitals and COVID-related health infrastructure as it announced support measures to cushion the pandemic’s blow on the economy.

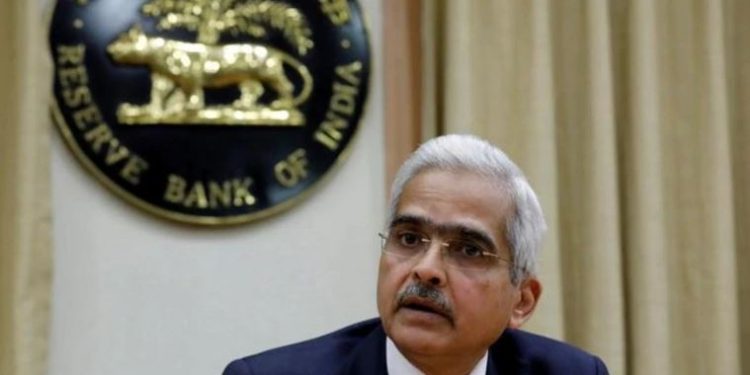

The moratorium of up to two years will be available to individuals and small and medium enterprises that did not restructure their loans in 2020 and were classified as standard accounts till March 2021, RBI Governor Shaktikanta Das in an unscheduled address. This facility will be available to borrowers with a total exposure of Rs 25 crore, he informed.

“In respect of small businesses and MSMEs restructured earlier, lending institutions are also being permitted as a one-time measure, to review the working capital sanctioned limits, based on a reassessment of the working capital cycle, margins, etc,” Das said.

Bankers had reportedly asked the RBI for a three-month moratorium, particularly for retail and small borrowers. This they said would prevent defaults.

Das also informed that RBI will give Rs 50,000 crore of liquidity support to banks for providing fresh lending ‘to a wide range of entities including vaccine manufacturers; importers/suppliers of vaccines and priority medical devices; hospitals/dispensaries; pathology labs; manufactures and suppliers of oxygen and ventilators; importers of vaccines and COVID related drugs; logistics firms and also patients for treatment’. These loans of up to three years tenor will be obtainable at repo rate and will be available till March 31, 2022.

PTI