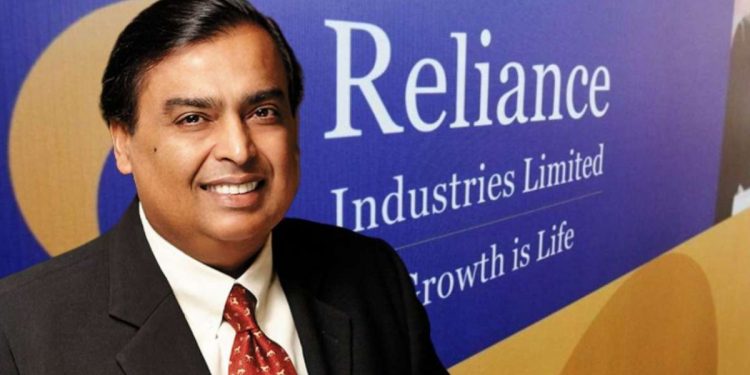

New Delhi: Billionaire Mukesh Ambani’s Reliance Industries Ltd reported Friday a 22.5 per cent rise in net profit for the quarter ended March on the back of bumper oil refining margins, steady growth in telecom and digital services and strong momentum in the retail business. The oil-to-retail-to-telecom conglomerate’s consolidated net profit rose to Rs 16,203 crore in the quarter ended March 31, 2022 from Rs 13,227 crore, the firm said in a statement.

Net profit, however, fell 12.6 per cent sequentially – breaking a six-quarter chain of quarter-on-quarter improvement.

Reliance’s earnings also rose because of a rise in broadband subscribers, online retail gaining traction and new energy investment picking roots.

Consolidated revenue of the nation’s biggest company by market value rose 35 per cent year-on-year to Rs 2.32 lakh crore in the fourth quarter of FY22.

For the full fiscal 2021-22 (April 2021 to March 2022), Reliance reported a net profit of Rs 60,705 crore on a revenue of Rs 7.92 lakh crore (USD 102 billion). It is the first Indian company to have crossed USD 100 billion revenue in a year.

The firm reported the highest-ever quarterly EBITDA (earnings before interest, taxes, depreciation and amortisation) of Rs 33,968 crore, up 28 per cent year-on-year.

O2C (oil-to-chemical) business EBITDA was up 25 per cent at Rs 14,241 crore, while digital services pre-tax earnings at Rs 11,209 crore were 25 per cent more than last year.

Retail EBITDA was up 2.5 per cent at Rs 3,712 crore and gas production from satellite fields in the KG-D6 block boosted oil and gas EBITDA over three folds to Rs 1,556 crore. Consumer business now accounts for nearly 45 per cent of segment EBITDA.

The Russian-Ukraine conflict accelerated an already tight demand-supply situation for crude oil-petroleum products, leading to higher cracks or margins on petrol and diesel.

Despite a reduction in subscriber base over the last two quarters due to culling of inactive subscribers/SIM consolidation, better per-user revenue (ARPU) and the refinancing of debt boosted net profit of Jio – the telecom and digital arm – by about 24% to Rs 4,173 crore in January-March. For the financial year ended March 31, 2022, Reliance Jio’s consolidated net profit increased by about 23 per cent to Rs 14,854 crore.

Retail went from strength to strength on the back of multiple bolt-on acquisitions, continued investment in building complementary offline-to-online infra and recovery in momentum post Covid-19.

The firm has invested more than USD 1 billion in acquiring assets and building capabilities of Reliance Retail and has opened more stores in tier-2 and 3 cities.

Jio Platforms – the digital arm – reported a 23 per cent higher net profit at Rs 4,313 crore as the telecom segment’s average revenue per user (ARPU) rose to Rs 167.6 per month, up 21.3 per cent. It had a customer base of 410 million, less than 421 million in the previous quarter, mainly driven by SIM consolidation.

Commenting on the results, Mukesh Ambani, CMD, Reliance Industries Limited, said: “Despite the ongoing challenges of the pandemic and heightened geopolitical uncertainties, Reliance has delivered a robust performance in FY2021-22.”

Ambani added: “Our relentless focus on customer satisfaction and service has led to higher engagement and increased footfalls, driving robust revenue and earnings figures across our consumer businesses.