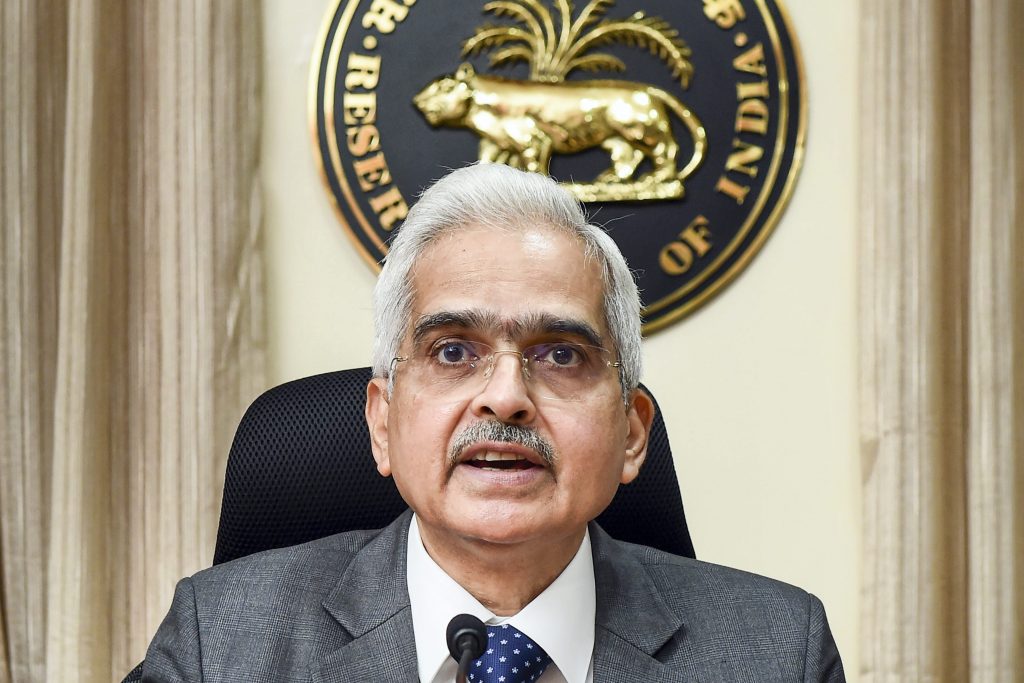

New Delhi: Despite extreme volatility in global stock markets, especially after US Federal Reserve chairman Jerome Powell’s Jackson Hole symposium remarks last week, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Monday that the Indian rupee has “held its own” and moved in an “orderly manner at a time of sharp depreciation in other currencies”.

“The recent commentary from the US Fed at Jackson Hole on the future trajectory of US monetary policy has infused substantial volatility into global financial markets, with large spillovers and knock-on effects on emerging market economies (EMEs),” Das said while delivering a speech during the annual event of Fixed Income Money Market and Derivatives Association of India (FIMMDA).

He, however, quickly went on to add that the RBI has intervened in forex markets to prevent excessive volatility in the exchange rate.

“RBI’s policy is to prevent excessive volatility of the rupee, or the exchange rate and also anchor expectations around the currency’s depreciation,” he said.

Das further indicated that the central bank’s monetary policy, going forward, will be “watchful, nimble-footed and calibrated”.

He also said that India is widely perceived to be the fastest growing economy in the world this year at a time when other major economies may actually be encountering recession or considerable moderation in their growth momentum.

Referring to Powell’s comments on keeping up with rate hikes, Das said that financial markets in India have recovered from the lows that they fell to in the immediate aftermath of the Jackson Hole event.

“In this turbulent global environment, the resilience exhibited by Indian financial markets reflects the robust macroeconomic fundamentals of the economy,” he added.

Last week, Powell, while speaking at the Jackson Hole symposium, had indicated that the US Federal Reserve is likely to keep the interest rates high for some time.

The comment had led to large-scale volatility in global markets.

IANS