New Delhi: Eminent economist Jayanth R Varma Sunday said the Russia-Ukraine conflict is likely to have adverse effects on both economic growth as well as inflation and policy makers must remain alert and ready to respond rapidly to the emerging situation.

Varma, who is also a member of the Monetary Policy Committee (MPC) of the Reserve Bank, in an interview to PTI said inflation is higher than target, though it is within the tolerance band.

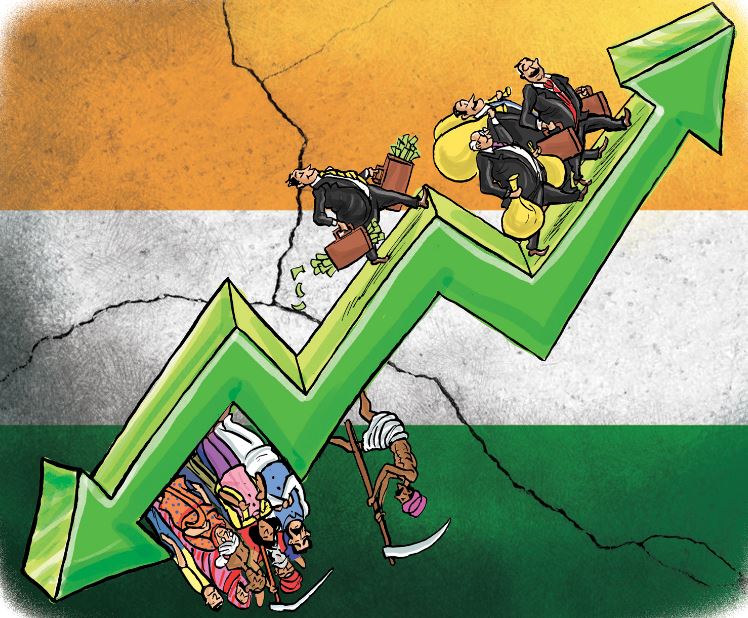

Listing challenges faced by the Indian economy, Varma said while the economy has yet to recover from the cyclical economic slowdown which began around three years ago, investment has remained subdued during this period, and private consumption has not fully recovered from the pandemic.

“The economy faces new stresses emanating from geopolitical tensions,” he said, adding that inflation is higher than the target though within the tolerance band.

Varma, who is a professor of finance and accounting in IIM Ahmedabad said: “The conflict is likely to have adverse effects on both economic growth and on inflation… Policy makers must in my view remain alert and stand ready to respond rapidly to the emerging situation.”

Asia’s third-largest economy is projected to grow 8.9 per cent in the fiscal year ending March 31, slower than previously anticipated 9.2 per cent, according to the recent government data.

“RBI projected 2022-23 inflation to be not much above the target of 4 per cent, but the degree of confidence in this point estimate is quite low, and there is a non-trivial chance of inflation ending up above the tolerance band.”

Varma further noted that the opposite is also true and the possibility of inflation being much lower than the estimate cannot also be ruled out.

He pointed out that the reason why it is so difficult to forecast inflation (both in India and globally) is that supply disruptions have been a big contributor to rising prices, and it is hard to say how long these disruptions will last.

He said the pandemic shifted demand from contact intensive services to goods.

“Consequently, there has been a shortage of goods on the one hand and a surplus capacity in services. Relative price changes that make goods more expensive and services cheaper are one way to rebalance the economy,” the eminent economist opined.

The retail inflation rate breached the 6 per cent upper tolerance limit of the RBI for the first time in seven months in January, while the wholesale-price index stayed in double-digits for the 10th month in a row.

The Reserve Bank of India (RBI) on February 10, had lowered the inflation outlook to 4.5 per cent for the next fiscal, from 5.3 per cent in the current year, on the assumption of a normal monsoon during the year.

RBI’s Monetary Policy Committee (MPC) had decided to hold the lending rate, or the repo rate, steady at 4 per cent, and the reverse repo, or the rate at which it absorbs excess cash from lenders, unchanged at 3.35 per cent.

To a question on taper tantrum, Varma said India is in a much better position to cope with US monetary tightening today than it was in 2013.

“The external reserves are comfortable and the current account deficit is manageable.

“Moreover, US tightening has been widely anticipated, and investors in emerging markets have had plenty of time to adjust their strategies to account for this,” he observed.

Of course, he said the tightening will still have a major impact on financial markets around the world.

“The dollar has strengthened against most other currencies in recent weeks, and the rupee has also conformed to this pattern,” he said, adding that “these price movements are not worrisome”.

The taper tantrum phenomenon refers to the situation in 2013, when emerging markets witnessed capital outflows and spike in inflation after the US Federal Reserve started to put brakes on its quantitative easing programme.

The US Federal Reserve has decided to end its bond purchasing programme in March and increase interest rates thereafter to control high inflation.

PTI