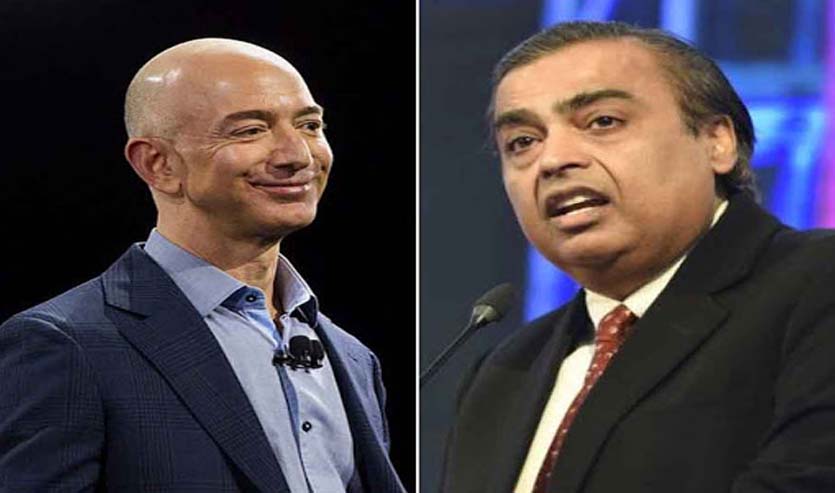

Mumbai: Equity indices spiralled lower Monday following heavy losses in Reliance Industries after Amazon won an interim arbitration award to stall the Mukesh Ambani-led firm’s acquisition of Future Group’s retail assets. A sharp fall in the rupee and a negative trend in global markets further unnerved investors, traders said.

After tanking 737 points during the day, the 30-share BSE index recovered some lost ground to end 540 points or 1.33 per cent lower at 40,145.50. The broader NSE Nifty tumbled 162.60 points or 1.36 per cent to 11,767.75.

Bajaj Auto was the top laggard in the Sensex pack, tumbling 6.10 per cent, followed by M&M, Reliance Industries (RIL), Tata Steel, Tech Mahindra, SBI, ICICI Bank and Axis Bank.

Index heavyweight RIL accounted for most of the losses, sinking 3.97 per cent, after Amazon.com Inc won an interim arbitration award against its partner Future Group for selling its retail business to Reliance Industries for Rs 24,713 crore.

Amazon, which acquired an indirect minority stake in the retail and fashion group last year, alleged that Future’s sale of its retail, wholesale, logistics and warehousing businesses to Reliance breached its pre-existing contract, which included a right of the first offer and a non-compete clause.

The Singapore International Arbitration Centre restrained Sunday Future Retail and its founders from going ahead with the sale until a final decision is given.

Nestle India, Kotak Bank, IndusInd Bank, PowerGrid and HUL were among the gainers, advancing up to 2.48 per cent. Kotak Mahindra Bank reported 26.7 per cent jump Monday in its standalone net profit to Rs 2,184.48 crore for the second quarter ended September 30.

Global markets were on the back foot amid an increase in COVID-19 cases in Europe and other regions and uncertainty over fresh stimulus in the US.

“Volatility was expected as we are nearing the US election date. The prices are high which limits the capacity of the market to handle uncertainties though the final outcome of the election is unlikely to change the long-term trend of the global market. Rising COVID-19 cases in the US and Europe and delay in US stimulus has added to worries,” said Vinod Nair, Head of Research at Geojit Financial Services

“Indian markets are taking a correction from the recent rally which has factored a lot about a uptrend in earnings growth due to positive Q2 results. Indian indices are expected to remain weak in the near-term and will be driven by the trend of ongoing Q2 result and developments in the US,” he added.

Meanwhile, international oil benchmark Brent crude was trading 2.04 per cent lower at USD 41.14 per barrel.

In the forex market, the rupee depreciated 23 paise to close at 73.84 against the US dollar.