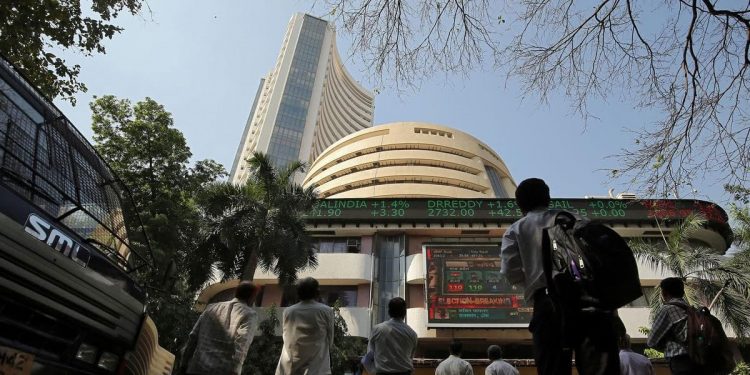

Mumbai: Benchmark Sensex plunged by 927 points to close at a three-week low while the broader Nifty settled at a four-month low Wednesday amid weak global trends as investors braced for the release of the Federal Open Market Committee minutes later in the day.

Falling for the fourth day in a row, the BSE Sensex tumbled 927.74 points or 1.53 per cent to settle at 59,744.98, the lowest closing level since February 1. During the day, it tanked 991.17 points or 1.63 per cent to 59,681.55.

The 50-issue NSE Nifty declined 272.40 points or 1.53 per cent to end at a four-month low of 17,554.30 with 47 of its constituents ending in the red.

From the Sensex pack, Bajaj Finance, Bajaj Finserv, Reliance Industries, Wipro, HDFC Bank, HDFC, ICICI Bank, and Tata Steel were the major laggards.

ITC was the lone winner in the Sensex pack.

In Asian markets, South Korea, Japan, China, and Hong Kong ended lower.

Stock exchanges in Europe were quoting in the negative territory in afternoon trade. The US markets had ended significantly lower Tuesday.

“Resurgence of cold war between US & Russia has brought apprehension in the market. Although it should be a short-term effect, the fear of sanctions against Russia and its degree of implication on the economy, especially on food and oil exports, is adding to the anxiety. The market is just recovering from the pandemic, and high interest & inflation are the headwinds in the background.

“It is presumed that this war will be fought on an economic front, limiting its effect on strong economies like the US & India. Awaiting the release of Fed and RBI minutes are the other major elements that kept investors on the sidelines,” said Vinod Nair, Head of Research at Geojit Financial Services.

International oil benchmark Brent crude declined 1.11 per cent to USD 82.11 per barrel.

Foreign Portfolio Investors (FPIs) bought shares worth Rs 525.80 crore Tuesday, according to exchange data.