London: European share markets followed Asian counterparts lower Monday as investors took fright at news Washington was set to announce a new round of tariffs on Chinese goods in the latest escalation of their trade conflict.

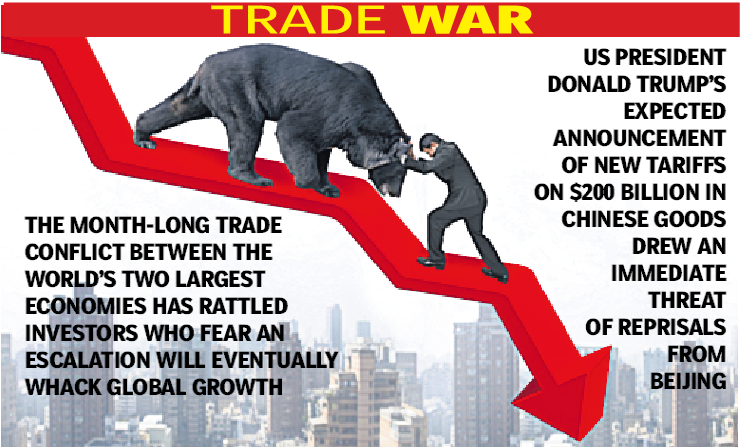

US President Donald Trump’s expected announcement of new tariffs on $200 billion in Chinese goods drew an immediate threat of reprisals from Beijing.

The month-long trade conflict between the world’s two largest economies has rattled investors who fear an escalation will eventually whack global growth, while talks between the two countries have failed to make much headway. The pan-European STOXX 600 index fell as much as 0.2 per cent, while Germany’s DAX, home to large exporters and carmakers, dropped half a per cent. France’s CAC 40 and Britain’s FTSE 100 fell 0.2 per cent and 0.1 per cent, respectively.

Europe’s STOXX 600 had last week enjoyed its best weekly gain since July as the Turkish central bank’s interest rate rise brought a broad relief rally, but the mood was less buoyant on Monday. However, after the initial falls there were signs that some investors were ready to look past the dispute, with European markets reducing their losses to trade close to flat by 0830 GMT.

Earlier in the day, MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 1.2 per cent, snapping three straight sessions of gains. World shares remain more than 5 per cent off their record highs touched in January, based on the MSCI world equity index , which tracks shares in 47 countries.

Sensex dives over 500 points

Mumbai: Stock markets registered sharp losses Monday, with the BSE Sensex ending 505 points lower against its previous close. While the BSE benchmark index Sensex settled at 37,585, the NSE Nifty plunged 137 points to end at 11,377. The sharp losses in the markets came after the announcement of steps by the government to stem the steep decline in the rupee amid a weak trend in other Asian markets. Analysts said continued weakness in the rupee along with concerns on the US-China trade war front hurt the markets. Banking, financial services, FMCG, energy and pharma shares led the decline in domestic equity markets.