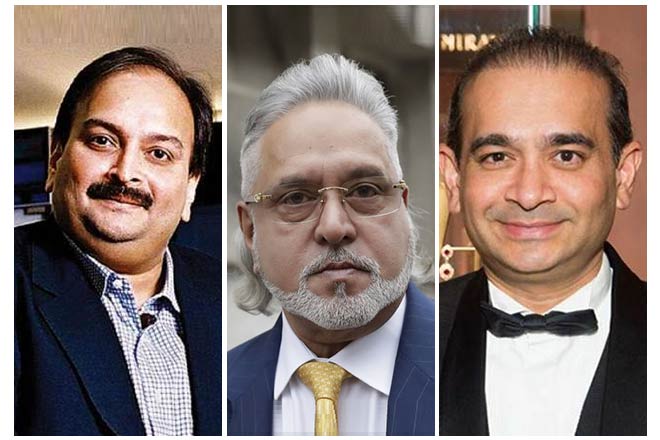

The Enforcement Directorate and the Modi government may have reasons to have a pat on their own backs after word spread the ED has managed to get back valuables worth Rs 1,350crore from Hong Kong. This, in the ongoing cases of bank fraud and money laundering filed against diamond merchants Nirav Modi and his uncle Mehul Choksi, who had also dabbled in real estate business. Notably, this is a small fraction of the huge wealth some businessmen have taken abroad from this country in recent years through shady channels after they took huge sums from public sector banks. Several of them found sanctuary abroad, including these two. Notably, some Rs 135 crore of such valuables had been brought back by the ED some time ago, in connection with the Nirav-Choksi cases.

This is a step forward, and the officials involved in the investigations need be hailed. At the same time, the way several other cases are not progressing is a matter of serious concern. Before the time when PM Modi took power in 2014, his promise at election meetings was that he would plough back all the black money stashed abroad by greedy businessmen who virtually looted Indian banks. The first five-year term of Modi did not see any progress in this respect, and small gains are reported of late. Vijay Mallya, the King of Good Times, is having a good time in the UK for years, and all “attempts” by the ED and other investigating agencies to get him back and make him repay his dues with PSU banks etc are not being of any help. There are many others in the same game.

Mallya played with the law in both India and UK, and even after the cases came to a dead end, he’s using his links with the UK government to avoid a deportation back to India. If by chance he returns, he will have more avenues open to pick up legal fights in Indian courts and still avoid paying the money he owed banks. Several PSU banks are at breaking point due to the NPAs or bad loans they advanced apparently flouting norms regarding collateral security etc, and some top bank officials had allegedly colluded in the dispersal of loans without sufficient guarantees to such business honchos. In Mallya’s case, the problems that plagued the aviation sector in India as a whole worked to his serious disadvantage, and he was perhaps a fair-minded, happy-go-lucky businessman who meant no mischief in normal course. But, the way he scooted from the scene and took refuge in another country meant he was ready to play dirty games, which is unacceptable. He has enough and more of assets in India, and he has expressed a willingness from UK to pay back the loans he has taken on conditions that the interest etc be waived and some favours extended to him. Both Nirav Modi and Mehul Choksi are safely put in the UK and the Bahamas respectively, and are fighting extradition cases filed by the ED, CBI etc. These could go on and on.

On the one side, the only industry that thrives in India seems to be taking huge loans from banks and scooting from the scene in order to park such money in foreign tax havens. The Indian manufacturing sector is going down and down for years, and only a few corporates are thriving obviously with strong support from the government. On the other, precious wealth from India is going away to foreign shores, and the banking system is at a stage of near-collapse; a reason why merger of PSU banks is now resorted to, to add new strength to these entities. All the mischief being played on the banking system is hurting the national economy as a whole. Corruption is so widespread that many people who have the ways and means to invest are not willing to come forward. This corruption is at multiple levels, and foreign entities too are mindful of the grim scenario here. They will not come and put their foot into a field where there is slush and mud, and no guarantee to their investments. Are courts helpful in meting out justice is also a big question. The normal in India, courts included, is to go round and round.