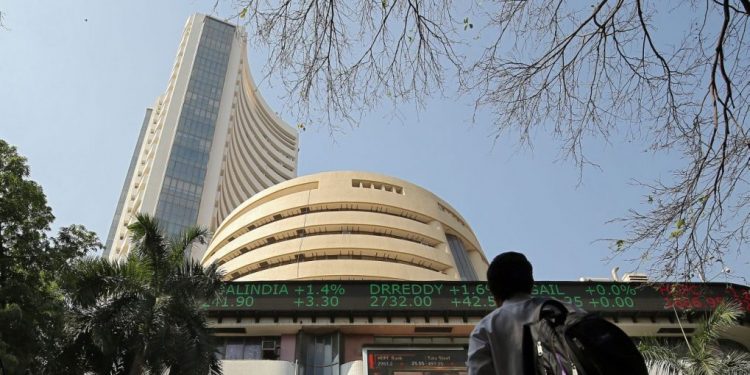

Mumbai: Benchmark equity indices Sensex and Nifty declined Monday due to profit-taking by investors after a record-breaking rally in the last week and a largely weak trend in Asian markets.

Snapping its three-day rally, the 30-share BSE Sensex declined 168.66 points or 0.24 per cent to settle at 71,315.09. During the day, it fell 341.46 points or 0.47 per cent to 71,142.29.

The Nifty fell by 38 points or 0.18 per cent to 21,418.65.

Among the Sensex firms, Power Grid, ITC, JSW Steel, ICICI Bank, Tech Mahindra, Infosys, IndusInd Bank and Mahindra & Mahindra were the major laggards.

Sun Pharma, Reliance Industries, HCL Tech, Hindustan Unilever, Bajaj Finance and Maruti were among the gainers.

Vinod Nair, Head of Research at Geojit Financial Services, said, “The market started on a subdued note as concerns over oil supply disruptions through the Red Sea and elevated valuations dented investor sentiment.”

In Asian markets, Tokyo, Shanghai and Hong Kong settled lower while Seoul ended in the green.

Europan markets were trading on a mixed note. The US markets ended mostly with gains Friday.

Global oil benchmark Brent crude declined 0.29 per cent to $76.33 a barrel.

Foreign institutional investors (FIIs) continued their buying momentum as they bought equities worth Rs 9,239.42 crore on Friday, according to exchange data.

Rising for the third day running, the BSE benchmark jumped 969.55 points or 1.37 per cent to settle at its record closing high of 71,483.75 Friday. During the day, it surged 1,091.56 points or 1.54 per cent to 71,605.76, its all-time intra-day high level.

The Nifty climbed 273.95 points or 1.29 per cent to settle at its new closing high of 21,456.65. During the day, it zoomed 309.6 points or 1.46 per cent to hit its record intra-day peak of 21,492.30.

PTI