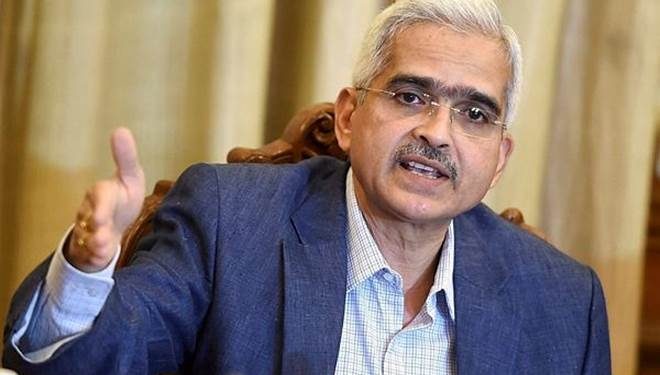

New Delhi: Hinting at more steps to revive growth, Reserve Bank of India Governor Shaktikanta Das Friday said that monetary policy alone cannot support growth and structural reforms and fiscal measures must continue for this purpose.

“Monetary policy, however, has its own limits. Structural reforms and fiscal measures may have to be continued and further activated to provide a durable push to demand and boost growth,” he said while delivering a lecture at the St Stephen’s College here on “Seven Ages of India’s Monetary Policy”.

He said the government is focusing on infrastructure spending which will augment growth potential of the economy. States should also play an important role by enhancing capital expenditure, which has a high multiplier effect.

Among the most important fiscal measures the government has taken so far is the cut in corporate taxes, apart from a host of sectoral measures. With retail inflation touching 7.35 per cent in December, the highest in six years, the Governor allayed fears over the current spike in inflation, saying it is triggered due to food prices rise.

He pointed due to the RBI’s consistent efforts, inflation has fallen successively and has averaged below 4 per cent since 2017-18, notwithstanding recent up-tick in inflation driven by food prices, especially the sharp increase in vegetable prices, reflecting the adverse impact of unseasonal rains and cyclone.

The efforts, Das said, related to the RBI fine-tuning its operating procedures of monetary policy for effective policy transmission across the financial markets and thereby onto the real economy.

The Governor highlighted the potential growth drivers which, through backward and forward linkages, could give significant push to growth. According to him, these include food processing industries, tourism, e-commerce, start-ups and efforts to become a part of the global value chain.

He said RBI is constantly updating assessment of the economy based on incoming data and survey based forward looking information juxtaposed with model-based estimates for policy formulation.

“This approach helped the Reserve Bank to use the policy space opened up by the expected moderation in inflation and act early, recognising the imminent slowdown before it was confirmed by data subsequently,” he said.