New Delhi:

The Goods and Services Tax (GST) Council meet Saturday ended with tax rates being cut for 23 items, including some consumer goods such as televisions, tyres, monitors, power banks and movie tickets.

In a bid to fulfill what Prime Minister Narendra Modi hinted at a few days ago that almost 99 per cent items will be brought under the 18 per GST slab, Finance Minister Arun Jaitley Saturday announced that the 28 per cent slab will now be applicable only on 28 items, which are mainly luxury goods and sin items.

The annual revenue implication of the rate cuts would be Rs 5,500 crore, Finance Minister Arun Jaitley said.

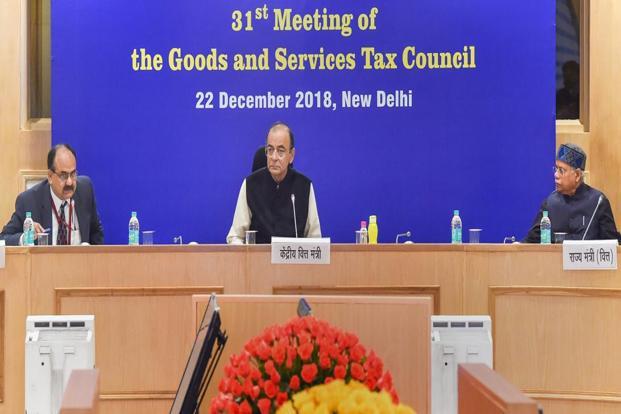

Briefing reporters after the 31st GST Council meeting here, Jaitley said rate rationalisation is an ongoing process.

“28 per cent bracket is gradually moving to sunset… The next target will be rate rationalisation in cement as and when affordability improves,” he said.

Now, the 28 per cent slab is restricted to only luxury and sin goods, apart from auto parts and cement — tax rates on which could not be cut due to the high revenue implication.

Jaitley said, “There are 28 items left in the 28 per cent bracket if we include luxury and sin items. Thirteen items are from automobile parts and one is cement. Cement’s revenue is Rs 13,000 crore and automobile parts revenue is Rs 20,000 crore. If they are brought down from 28 per cent to 18 per cent implications are of Rs 33,000 crore.”

GST on movie tickets costing up to Rs 100 was cut to 12 per cent from 18 per cent, while tickets over Rs 100 will attract 18 per cent tax, against 28 per cent earlier. This will have a revenue implication of Rs 900 crore.

Monitors and TV screens up to 32-inches and power banks will attract 18 per cent GST, as against 28 per cent earlier.

In addition, services provided by banks to Jan-Dhan account holders will be exempted from GST.

The new tax rates will come into effect from January 1, 2019.

PTI