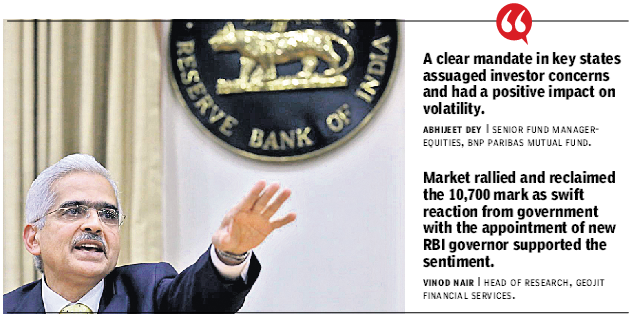

New Delhi: Shaktikanta Das, who has been appointed as the new governor of Reserve Bank of India (RBI) Das said Wednesday he would adopt a consultative approach and move quickly to meet bank chiefs and other parties to tackle issues facing the sector.

“I will try and uphold professionalism, core values, credibility and autonomy of this institution. It’s an honour and great opportunity to serve RBI. I will try my best to work with everyone and work in the interest of Indian economy,” Das said at his first news conference after taking charge Wednesday.

Speaking on the relations between the Central government and the RBI, the new Governor said, “I don’t know if the relationship is good or not but we have to have stakeholders’ consultation. The government is not just a stakeholder but also runs the country, economy and manages major policy decisions. So, there has to be a discussion between the government and the RBI.”

His predecessor, Urjit Patel, resigned on Monday following a drawn out dispute with the government.

Das said the banking sector faced a lot of challenges, and many more measures needed to be taken. He said, he planned to host a meeting with a number of bank chiefs Thursday to immediately address the needs of the sector.

“I have convened a meeting with CEOs and MDs of public sector banks Thursday morning. Banking is an important segment in our economy. It is facing several challenges that need to be dealt with. It is the banking sector on which I would like to focus on immediately,” he said.

Das also said it was “heartening” to note that the inflation outlook looked benign at this stage.

“The inflation target continues to be very important. It is really heartening that it has been very good but we have to ensure stability. The issue of liquidity is also important and I will work on these issues too. The maintenance of the growth trajectory of the Indian economy is extremely important,” he added.

Analysts said investors were optimistic over the swift appointment of Das as the 25th Governor of the Reserve Bank as it might lead to a more liberal monetary policy.

Hopeless Hong Kong

The last nail into the coffin of whatever freedom is believed to be there in Hong Kong, a unique territory...

Read moreDetails